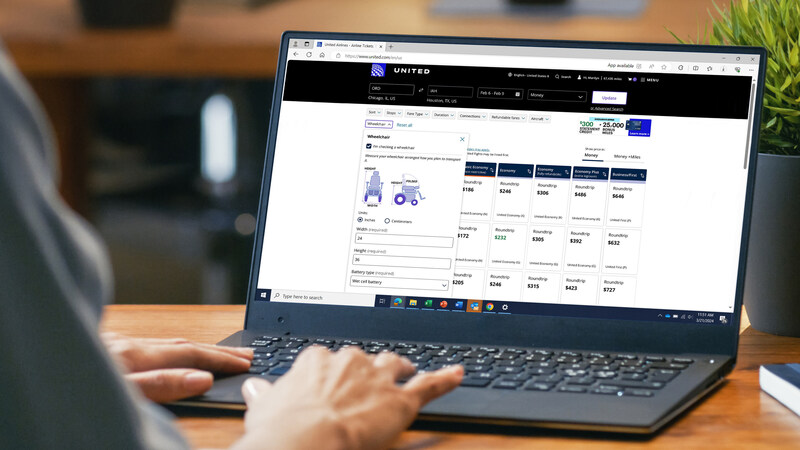

New Zealand credit cards with top rewards

- October 3, 2016

When it comes to travel, nothing is more valuable than a truly good credit cards. They can earn you enormous amounts of points from everyday spending, that you can use for fanciful redemptions to cities all over the world, on all sorts of airlines, and in all cabin classes. It’s a confusing world, though, as every credit card has varying levels of return and value, with some providing frequent flyer sweet spots and others simply ways of taking your money.

American Express Platinum Card

This top-of-the-range card offers an enormous amount of extra rewards (including Priority Pass, hotel Elite status, travel insurance and $200 travel credit), whose value instantly offsets the annual fee. It is a charge card, which works slightly differently to a credit card, and earns American Express Membership Reward Points. These can be transferred to one of 7 partner airlines (Air New Zealand, Cathay Pacific, Emirates, Malaysia Airlines, Qantas, Singapore Airlines, Virgin Australia), at a rate of 2 rewards points to 1 airline mile, effectively netting 1 airline mile per dollar you spend (for Air New Zealand the rate is 175 rewards points to 1 AirPoints Dollar).

Annual Fee

- $1250

Points Earn Rate

- $1 = 2 Membership Rewards Points

Spend required for Auckland – Singapore return

- $95,900 (Air New Zealand)

- $42,500 (Singapore Airlines)

American Express AirPoints Platinum Card

This card’s highlight is probably the very favourable AirPoints earn rates and the ability to earn status credits on everyday spending, helping you to qualify for AirPoints Elite tiers. Along with a complimentary domestic flight each year and Koru Club discounts, this card provides best value when used with Air New Zealand only.

Annual Fee

- $395

Points Earn Rate

- $75 = 1 AirPoints Dollar

- $250 = 1 Status Credit

Spend required for Auckland – Singapore return

- $82,200 (Air New Zealand)

- $120,000 (Singapore Airlines)

American Express Platinum Edge Card

This is Amex’s lower rate card that provides very generous earn rates depending on where you spend. As well as being able to transfer points to the usual seven airline partners, travel insurance and a complimentary annual domestic flight are both included as rewards. The favourable transfer rates offer the best value when used with airlines other than Air New Zealand.

Annual Fee

- $149

Points Earn Rate

- $1 general expenses = 1 Membership Reward Point

- $1 major petrol stations = 2 Membership Reward Points

- $1 major supermarkets = 3 Membership Reward Points

Minimum spend required for Auckland – Singapore return

- $63,900 (Air New Zealand)

- $28,333 (Singapore Airlines)

American Express AirPoints Card

This is the simplest American Express offered card, carrying NO annual fee. As such it is the cheapest and simplest way to earn AirPoints for everyday spending. The rewards you earn provide the best value when used with Air New Zealand, as they cannot be transferred to partner airlines.

Annual Fee

- $0

Points Earn Rate

- $100 = 1 AirPoints Dollar

Spend required for Auckland – Singapore return

- $109,600 (Air New Zealand)

- $160,000 (Singapore Airlines)

Westpac AirPoints World MasterCard

Westpac’s most premium card offers New Zealand’s best direct rate for earning AirPoints dollars, also with favourable rates for status credits. It is accompanied by Koru Club discounts, Priority Pass membership and travel insurance, and provides great value for travel with Air New Zealand, although less so with their partners.

Annual Fee

- $390

Points Earn Rate

- $65 = 1 AirPoints Dollar

- $220 = 1 Status Credit

Spend required for Auckland – Singapore return

- $71,240 (Air New Zealand)

- $104,000 (Singapore Airlines)

ANZ AirPoints Platinum Visa

This card is very comparable to the American Express alternative, offering identical earning rates, as well as travel insurance, Koru Club discounts and a return domestic flight every year. Bear in mind that redemptions on partner airlines provide far less value than with Air New Zealand directly, and as such this card works best for Air New Zealand rewards.

Annual Fee

- $150

Points Earn Rate

- $75 = 1 AirPoints Dollar

- $250 = 1 Status Credit

Spend required for Auckland – Singapore return

- $82,200 (Air New Zealand)

- $120,000 (Singapore Airlines)

ANZ Qantas Platinum Visa

This is the only major card with a direct partnership with an airline other than Air New Zealand. It provides complimentary travel insurance, and the ability to use miles on the entire OneWorld network and across Qantas partners, however the earn rate does revert to a lower level after a threshold value.

Annual Fee

- $150

Points Earn Rate

- $1 = 1 Qantas Point (up to 20,000 points/ year)

- $2 = 1 Qantas Point (over 20,000 points/ year)

Spend required for Auckland – Singapore return

- $120,000 (Qantas)

BNZ Visa Platinum

This card works contrary to most, and offers an option to either be rewarded with direct cash-backs, or by learning FlyBuys Points. These points can only be redeemed on Air New Zealand operated flights, and partner airlines are excluded. FlyBuys prices are worked out by converting an airfare, and as such the value can change dramatically depending on how much tickets cost at the time. In general, though, there is better value in using the points for cheaper, shorter sectors (with far lower spend required than other cards).

Annual Fee

- $145

Points Earn Rate

- $15 = 1 FlyBuys Point

Spend required for Auckland – Singapore return

- $131,265 (Air New Zealand)

Spend required for Auckland – Sydney return

- $19,650 (Air New Zealand)

The New Zealand credit card offerings provide a very wide range of value options, depending upon what the card is best used for. AirPoints branded cards are most valuable for redemptions with Air New Zealand only, whilst American Express Membership Rewards cards work best with other airline partners. It is important to analyse the various specifications and details to work out which card fits your spending habits and lifestyle.

For more information on how to get maximise reward points visit www.iflyflat.com.au